Trump Biden Tax Plan Comparison

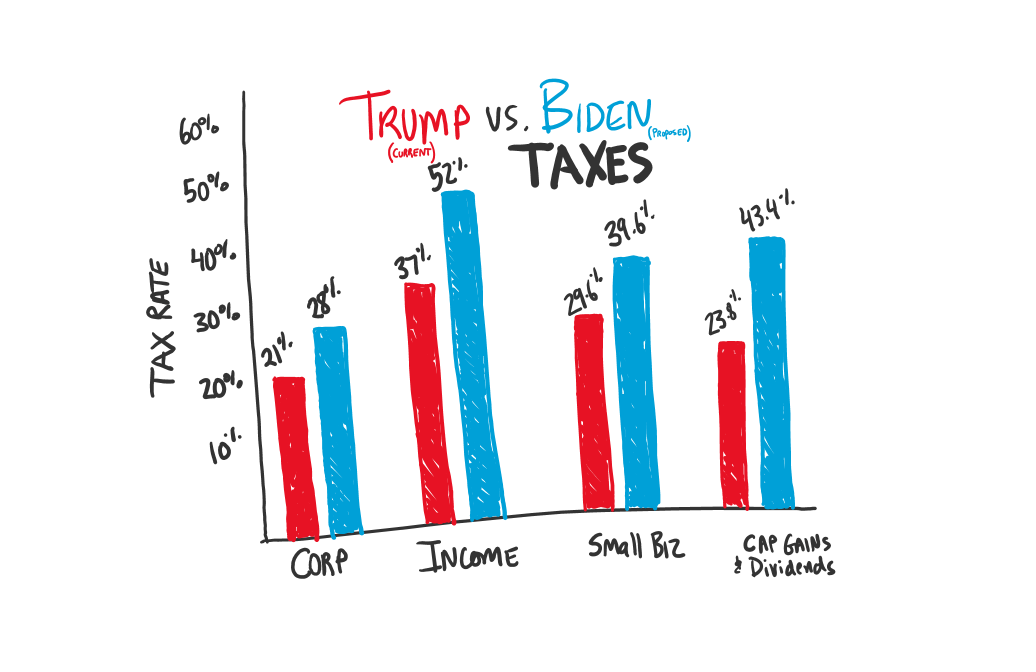

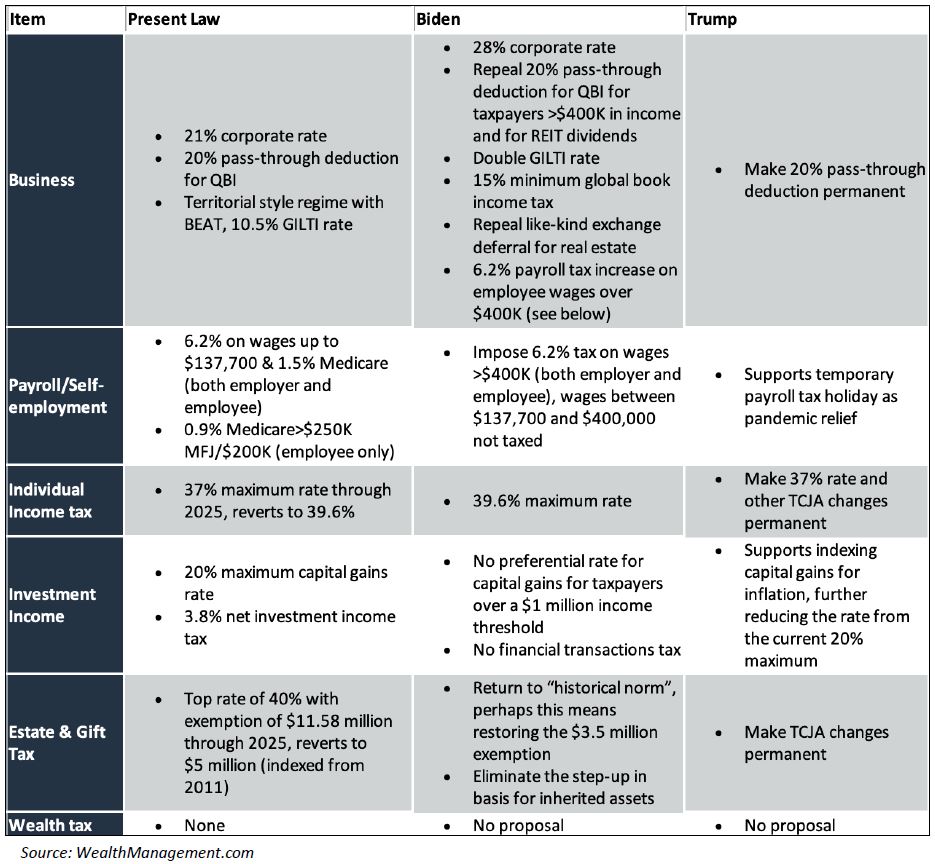

According to washington budget experts the biden tax plan would raise 3 8 billion in revenue over. Biden wants to raise the top income tax rate back to 39 6 from 37 and the top corporate income tax rate to 28 from 21.

Currently the top tax rate is 37 down from the highest rung of 39 6 prior to the tcja.

Trump biden tax plan comparison. Biden s tax plan generally calls for tax increases on wealthy individuals and on businesses. Trump passed the tax cuts and jobs act tcja in 2017 one of the largest tax reforms in history. If elected he will apply social security taxes to earnings above.

His plan would rollback the tax cuts in the tax cuts and jobs act of 2017 tcja for high income households and corporations and increase taxes on capital gains. Following is a brief comparison. What would the proposed tax increases actually cost taxpayers.

Biden s proposed tax plan the chart above referenced the difference between current taxes and biden s proposed tax rates. Differences in economic policy. An estimated 3 5 trillion in new taxes over the next decade.

Biden plans to increase the top income tax rate from 37 to 39 6. Biden s tax proposals would represent a significant increase in tax on investors. In 2017 the trump administration enacted tax cuts that lowered the tax rate on corporations from 35 to 20.

He credits his tax plan for unleashing the american economy citing gdp growth over 3 for four quarters of his administration and the lowest unemployment level in over fifty years pre covid 19. With former vice president biden s plan the highest earning individuals and companies would see tax increases while low and middle income tax rates. Enact a 10 middle class tax cut which reportedly could include lowering the 22 marginal tax rate to 15.

For 2020 the 22 marginal tax rate applies to income over 40 125 for. Biden also plans to subject. Under president trump s plan high income taxpayers and corporations would see the largest tax reductions and benefits though there is a promise of a 10 tax cut for middle income earners.

Biden wants to restore the. British publication the economist s comparison of the economic policies of the two candidates is available here and their review of biden s policies is here. Joe biden s tax plan.

The figure for income and payroll tax is correct only for business owners in the highest tax bracket. President trump has not yet released a tax plan for 2021 but has made statements about extending tax cuts under the 2017 tax reform law commonly known as the tax cuts and jobs act tcja and about enacting further middle class tax cuts.

Joe Biden S Plan Would Create 7 Million More Jobs Than Trump Moody S Business Insider

Financial Planning Prior To Election Boston Private

Financial Planning Prior To Election Boston Private

Economy Would Do Better Under Biden Than Trump Moody S The Fiscal Times

Economy Would Do Better Under Biden Than Trump Moody S The Fiscal Times

:max_bytes(150000):strip_icc()/GettyImages-503233933-72a6e557fbe74c9c83d68ce0af3b4cd6.jpg) Biden Vs Trump Economic Plans Compared

Biden Vs Trump Economic Plans Compared

Biden Vs Trump Trump Vs Biden Who Do You Think Will Win The 2020 U S Presidential Election Youtube

Biden Vs Trump Trump Vs Biden Who Do You Think Will Win The 2020 U S Presidential Election Youtube

The 2020 Election Tax Comparison Trump V Biden Wes Moss

The 2020 Election Tax Comparison Trump V Biden Wes Moss

Trump V Biden Tax Comparison Wes Moss

Trump V Biden Tax Comparison Wes Moss

Fivethirtyeight On Twitter Two Economists Concluded That Biden S Tax Plan Isn T All That Different From Trump S While There Are Pretty Big Differences Between The Warren And Sanders Plans Https T Co Rde2dcc0hp Https T Co F4sxcvrg9z

Fivethirtyeight On Twitter Two Economists Concluded That Biden S Tax Plan Isn T All That Different From Trump S While There Are Pretty Big Differences Between The Warren And Sanders Plans Https T Co Rde2dcc0hp Https T Co F4sxcvrg9z

Trump Biden First Debate C Span Org

Trump Biden First Debate C Span Org

The 2020 Election Tax Comparison Trump V Biden Youtube

The 2020 Election Tax Comparison Trump V Biden Youtube

Proposed Tax Plans Of The 2020 Presidential Candidates

Proposed Tax Plans Of The 2020 Presidential Candidates

Family Office Connections A Comparison Of The Trump And Biden Tax Plans Boston Private

Family Office Connections A Comparison Of The Trump And Biden Tax Plans Boston Private

Is Post Crash Rally Volume Telling Us Something Valuetrend

Is Post Crash Rally Volume Telling Us Something Valuetrend

Comparing The Trump And Biden Tax Plans Acima Private Wealth

Comparing The Trump And Biden Tax Plans Acima Private Wealth

Ben Geier Savings Retirement And Investing Expert Smartasset Com

Ben Geier Savings Retirement And Investing Expert Smartasset Com

Difference Between Joe Biden And Donald Trump Difference Between

Komentar (0)

Post a Comment